This is my very first blog post and the goal is to give useful and actionable advice regarding the current Federal Reserve posture.

But first, I think it is important to explain that I have lived in Durango, Colorado, for over 25 years, and my wife, Angela, and I have raised five kids here. We have enjoyed all that Durango has to offer including hiking, mountain biking, skiing, sledding, and rafting down the Animas River. Durango really is a great place to raise a family. As my children graduate high school and college and begin to enter careers and raise families of their own, I am constantly reminded of the importance of managing finances and investments, no matter what life stage you’re in.

The US has seen unprecedented economic changes in the last three years, and I find I have spent a lot of time explaining to both my kids and my clients what the Federal Reserve is, how it works, and how to use one’s understanding of the Federal Reserve to make financial decisions.

As a mortgage lender, I am constantly reminded of how important interest rates are to an individual’s financial situation. You can explore our calculators here to see the impacts of interest rates here on our website.

So that’s my goal here – to shed some light on what the Federal Reserve is and how it impacts your finances and investments.

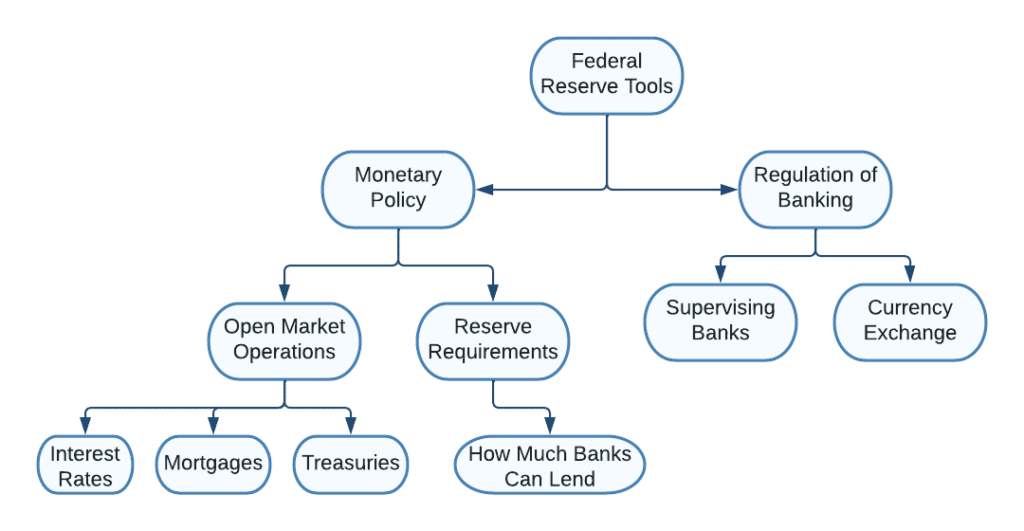

The Federal Reserve, or the “Fed”, is the central bank of the US. It is responsible for setting monetary policy, which includes the interest rates that banks charge to lend money to one another and to their customers. The Fed also regulates the banking industry, oversees the nation’s payment systems, provides financial services to the government, and plays a crucial role in ensuring the stability of the financial system.

Unsurprisingly, the Federal Reserve is complex but the most important concept to understand is this:

The Fed’s ultimate goal is to provide price stability and maximum employment, and they have certain tools they can use to achieve this. In attaining price stability, one of the downstream effects can be reducing employment. Conversely, when the Fed attains full employment, one of the results can be the destabilization of prices, also known as inflation.

Let’s take a closer look at how the Fed actually accomplishes these goals.

The first way is by setting monetary policy. The Fed uses two main tools to influence monetary policy: open market operations and reserve requirements.

Open market operations are when the Fed buys or sells securities in the open market to influence short-term interest rates. Reserve requirements are the percentage of deposits that banks must hold in reserve and are not available for loan growth. By changing these requirements, the Fed can influence the amount of money that banks have available to lend, which in turn affects interest rates and economic activity.

The second way the Fed promotes its goals is through regulation and supervision of the banking industry. The Dodd-Frank Act of 2010 expanded the Fed’s regulatory authority, giving it responsibility for supervising larger banks and overseeing important parts of the payment system. Through regulation and supervision, the Fed helps ensure that banks are sound and stable, which helps promote a secure financial system overall. By providing financial services to the government, such as currency exchange and check clearing, the Fed helps promote fiscal stability as well.

The job of the Fed is constantly a balancing act.

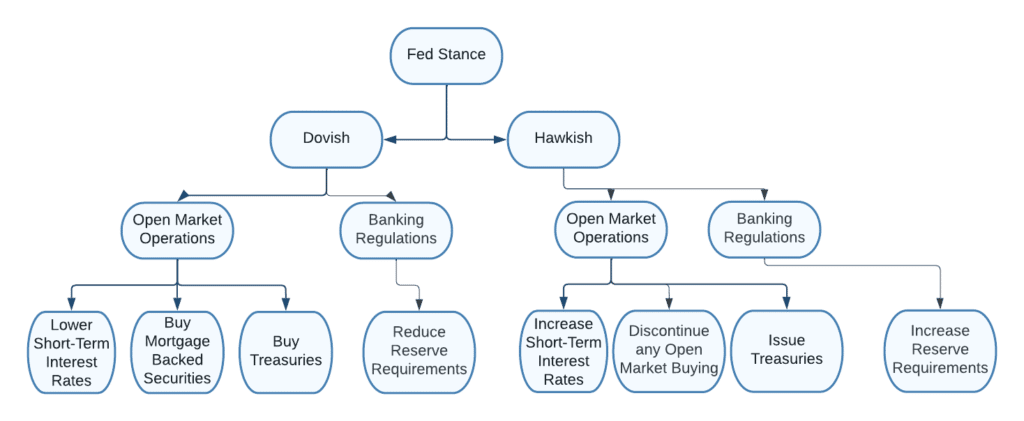

The Fed is generally either “dovish”, in a quantitative easing stance, OR “hawkish”, in a quantitative tightening stance.

- When the Fed is “Dovish” that means unemployment is high and prices tend to be low. The Fed is dovish because it wants to create economic expansion and provide easy money. The fed wants to put Money Into the system.

- When the Fed is “Hawkish” that means that the unemployment rate is likely very low and prices could be very high, like in an inflationary period. The Fed is hawkish because it wants to slow down economic expansion. The Fed wants to take Money Out Of the system.

Here is a chart illustrating some of the actions the Federal Reserve will take in each stance:

This is the important part.

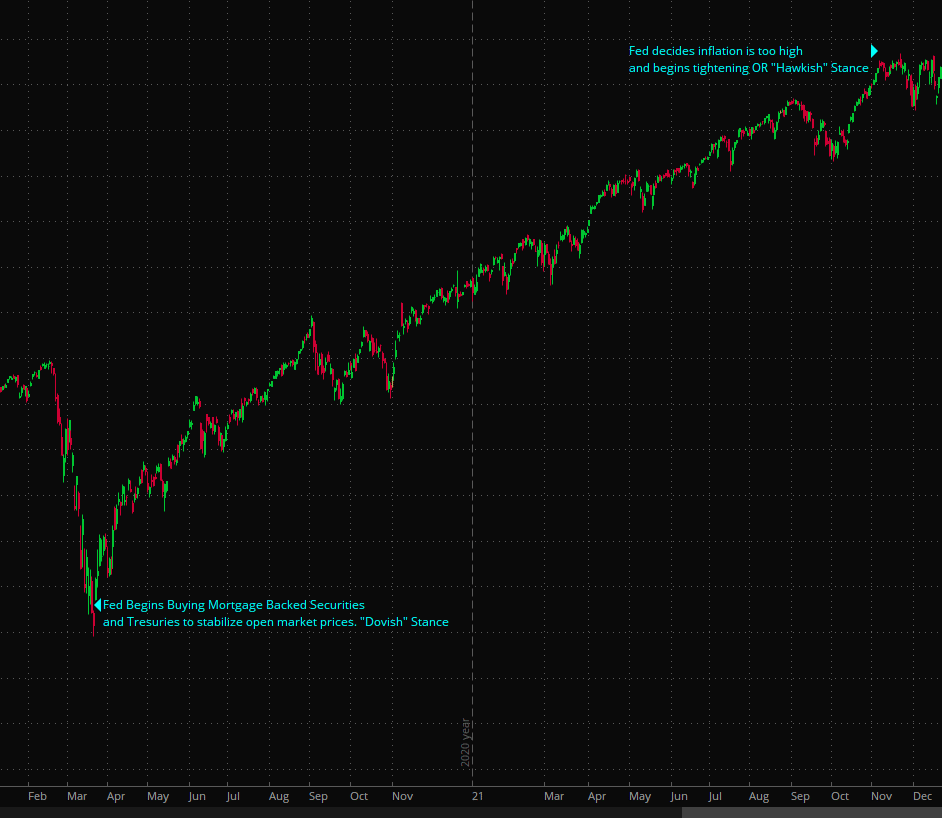

When the Fed is easing or dovish like it was from mid-March 2020 until late November 2021, the stock market tends to rise unimpeded. Take a look at the S&P 500 from March 2020 through the end of 2021:

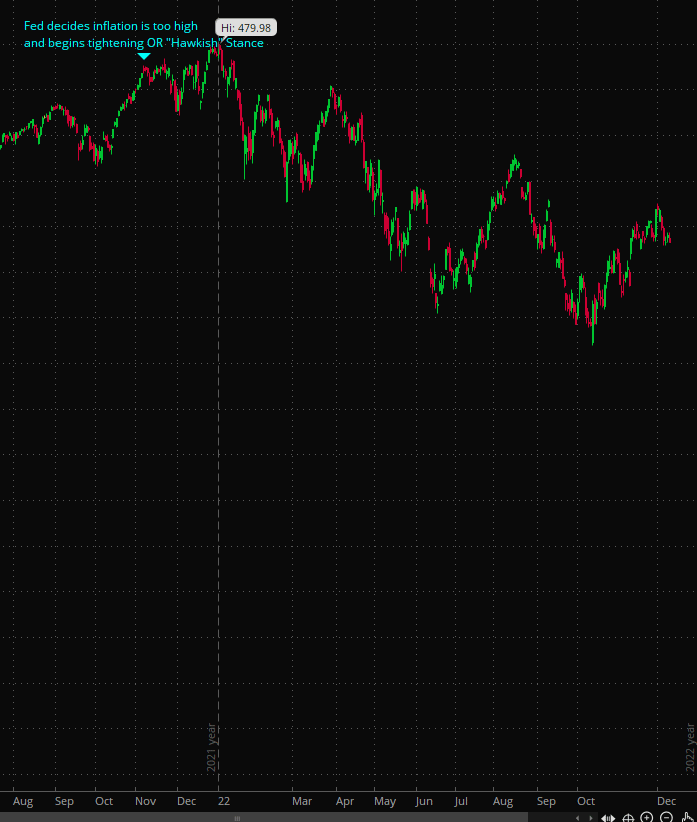

And likewise, when the Fed is tightening or hawkish like it was from November 2021 until present day, the stock market has been extremely volatile and has tended to go down overall, as seen by the S&P 500 activity from December 2021 through November 2022:

How does the Federal Reserve action apply to your financial planning and investments?

- If the Fed is dovish or easing, then unemployment is high and prices are low, and the Fed is using tools to put money into the system. You should consider putting your money in risk assets, like stocks.

- If the Fed is hawkish or tightening, then unemployment is low and prices are high, and the Fed is using tools to take money out of the system. You should consider a couple of options: A) Rebalance your portfolio into a more inflation-friendly group of investments, or at the very least B) Reduce your exposure to risk assets like “Stocks”

Please remember that I am not a financial advisor, and everyone’s situation is different, given their finances and current life stage. You should always consider consulting a professional advisor to get advice on the best move for you and your family in your situation.

You are likely the primary manager of your personal finances. By understanding what the Fed is and how it uses different tools to achieve its goals of maximum employment and price stability, my hope is that you feel confident making a sound financial decision in any given economic environment.

Hope this helps you and your family for years to come.

~ Peter

All Newsletters

SEE MOREFedWatch Update: Navigating the Federal Reserve’s Monetary Policy February 8, 2024

The Fed’s campaign of interest rate hikes spanned over 18 months, representing a significant intervention in the central bank’s history. These measures have transitioned the Fed into a phase of observation, as it awaits indications of declining inflation rates towards its 2% target, as measured by the Personal Consumption Expenditure (PCE) index, a preferred inflation gauge.

When should you Refinance? February 1, 2024

When should I refinance?

Permanent vs. Temporary buydowns February 5, 2024

Mortgage Buydown Comparison: Which type of buydown is best?